Market Prep: Rare Statistical Extremes 📉

DCMM MVP Pre-Market Data Scan 📊

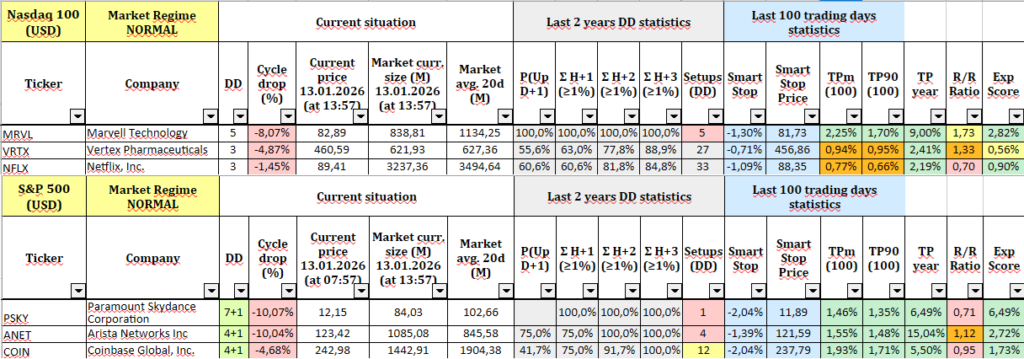

STATISTICAL EDGES (High Prob):

$MRVL

• P(Up D+1): 100%

• Σ H+3 (>1%): 100% (N=5 for 2 years)

• Vol_Ratio: 0.74x (Healthy/Quiet)

• Cycle Depth: -8.07%

$ANET

• Σ H+3 (>1%): 100% (N=4 for 2 years)

• Vol_Ratio: 1.28x (Normal)

• Cycle Depth: -10.04%

>> ANOMALY ALERTS (Cycle Invalidated):

$COF: Vol 3.8x (⚠️ Critical) | Event: Reg.Cap

$SYF: Vol 2.9x (⚠️ High) | Event: Reg.Cap

$IPG: Vol 7.6x (⚠️ Extreme)

MARKET REGIME:

Tech: Mean Reversion Active.

Financials: Outlier Mode / Avoid.

*Data, not advice.