US Market Prep: 14.01.2026

DCMM MVP Pre-Market Data Scan 📊

STATISTICAL EDGES (High Confidence):

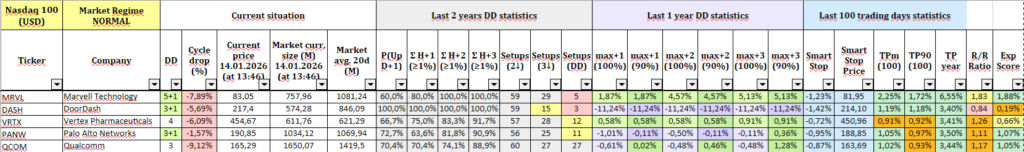

$QCOM (Qualcomm) 💎

- Σ H+3 (>1%): 88.9%

- Sample Size: N=27 (Huge!)

- Cycle Depth: -9.12%

- Logic: 27 similar crashes in 2 years. 24 recoveries. Pure math.

$VRTX (Safe Bet)

- Σ H+3 (>1%): 91.7% (N=12)

- Vol_Ratio: 0.98x (Normal)

- Status: Defensive bounce setup.

$MRVL (Momentum)

- Σ H+3 (>1%): 100% (N=5)

- Vol_Ratio: 0.70x (Healthy/Quiet)

- Status: Mean Reversion Pulse Active ⚡️

ANOMALY ALERTS (Avoid):

$BAC: Edge 41% (⚠️ Low) | Event: Earnings Today

$IPG: Vol 7.7x (⚠️ Extreme) | Event: Black Swan

$COF: Vol 2.1x (⚠️ High) | Event: Reg.ShockMARKET REGIME:

Focus: High Sample Size (N>10).

Action: Ignore low-liquidity noise ($DASH), trade the heavyweights ($QCOM).

*Data, not advice.